Responsibility Accounting- expense and revenue centre

RESPONSIBILITY

ACCOUNTING

Meaning

Responsibility accounting is a system of

dividing an organization into similar units, each of which is to be assigned

particular responsibilities. Responsibility accounting is a

management control system based on the principles of delegating and locating responsibility. Responsibility accounting is a system under

which managers are given decisions making authority and responsibility for each

activity occurring within a specific area of the company. Under this system,

managers are made responsible for the activities of segments. These segments

may be called departments, branches or divisions etc. Among the control

techniques “responsibility accounting” has assumed considerable significance.

While the other control devices are applicable to the organization as a whole,

responsibility accounting represents a method of measuring the performance of

various divisions of an organization.

Definition

According

to Charles T. Horongrent,

“Responsibility

Accounting or profitability accounting or activity accounting which means the

same thing, is a system that recognizes various decision or responsibility

centers throughout the organization and traces costs (and revenue, assets and

liabilities) to the individual managers who are primarily responsibility for

making decisions about the costs in question.”

Some

Basic Requirements

·

To

implement a responsibility accounting system, the business must be organized so

that responsibility is

assignable to individual managers.

·

The

various managers and their lines of responsibility should be fully defined.

·

The

organization chart is usually used as a basis for responsibility reporting.

RESPONSIBILITY CENTRES

For effective control, a large firm is usually divided into

meaningful segments, departments or divisions. These sub units or divisions of

an organization are called responsibility centres.

Responsibility centre is a segment or an

autonomous unit or division of a company defined according to function or

product line. For e.g.-

a. Function- marketing, production, finance, etc.

a. Function- marketing, production, finance, etc.

b. Product line- shoe

department, electrical products, food division, etc.

A responsibility

centre is a segment of an organization for which a particular executive is

responsible.

In the words of Deakin and Maher,

“A responsibility centre is a specific unit of an

organization assigned to a manager who is responsible for its operations and

resources.”

For control purposes, responsibility centres are generally categorized into-

1.

Cost /

expense centre

2.

Revenue centre

3.

Profit

centre

4.

Investment

centre

COST / EXPENSE CENTRE

An expense centre is a responsibility centre in which inputs,

but not outputs, are measured in monetary terms. Responsibility accounting is

based on financial information relating to inputs (costs) and outputs

(revenues). In an expense centre of responsibility, the accounting system

records only the cost incurred by the centre but the revenues earned (outputs)

are excluded. An expense centre measures financial performance in terms of cost

incurred by it. In other words, the performance measured in an expense centre

is efficiency of operation in that centre in terms of the quantity of inputs

used in producing some given output.

The modus operandi is to compare actual inputs to some

predetermined level that represents efficient utilization. The variance between

the actual and budget standard would be indicative of the efficiency of the

division. Cost centres are usually the most basic unit of responsibility accounting.

Types of cost / expenses centres-

There are generally two types of expense centres:

1.

Engineered

expense centre

2.

Discretionary

expense centre

ENGINEERED EXPENSE CENTRE

Engineered expense centre have the following characteristics:

·

Their

inputs can be measured in monetary terms.

·

Their

output can be measured in physical terms.

·

The

optimal rupee amount of input required to produce one unit of output can be

established.

Engineered expense centre usually are found in manufacturing

operations. Warehousing, distribution, trucking and similar units in the

marketing organization also may be engineered expense centre and so many

certain responsibility centre within administrative and support department.

Examples are accounts receivable, account payable and payroll section in the

controller department, personnel record and cafeteria in the human resource

department, shareholder record in the corporate secretary department etc. such

units perform repetitive task for which standard cost can be developed. In an

engineered expense centre the output multiplied by the standard cost of each

unit produced represents what the finished product should have cost. When this

cost is compared to actual costs, the difference between the two represents the

efficiency of the organization unit being measured.

Expense centre supervisor are responsible for the quality of

good and for volume of production in addition to their responsibility for cost

efficiency. Therefore the type and amount of production is prescribed and

specific quality standards are set so that manufacturing costs are not

minimized at the expense of quality.

For example:

The

report of an expense centre is given below:

This

shows that the expense centre has spent more than budgeted. This means that the

expense centre is not performing efficiently and is held responsible for the

unfavorable performance of the department.

DISCRETIONARY EXPENSE CENTRE

The output of discretionary expense centre cannot be measured

in monetary terms. They include administration and support units, research and

development organization and most marketing activities.

Management has decided on certain policies that should govern

the operation of the company i.e. whether to match, exceed or spend less than

the marketing effort of its competitors, the appropriate amount of spending on

research and development, etc.

The difference between the budgeted and actual expense is not

a measure of efficiency in a discretionary expense centre, it is simply the

difference between the budgeted and actual input. It, in no way, measures the

value of output. If actual expenses do not exceed the budget amount the manager

has “lived within the budget”. We cannot say that living within the budget is

efficient performance.

COST DEFINED IN TERMS OF CAUSE AND EFFECT

|

||

Type Of Cost

|

Cause And Effect Or

Cost Benefit Relationship

|

Examples

|

Discretionary

|

Relationships are difficult or impossible to

define.

|

Cost of administration and support services

such as employee training, legal advice, research and development, etc.

|

Engineered

|

Relationships are relatively easy to define.

|

Direct resources used in productive

activities such as direct materials, etc.

|

Revenue centre

In a revenue centre, output (i.e. revenue) is measured in

monetary terms, but no formal attempt is made to relate input (i.e. expense or

cost) to output (if expense was matched with revenue, the unit would be a

profit centre). Typically revenue centre

is marketing or sale unit wh8ich do not have authority to set selling price and

are not charged for the cost of goods they market.

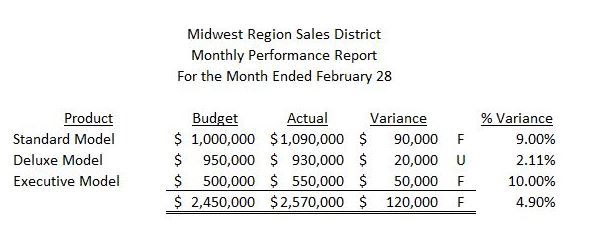

| Revenue Center Performance Reports | |||

A revenue center performance report looks very

similar to a cost center performance report.

Notice that the only

difference is the name at the top of the report and that the word “expense” has

been replaced with “product”. Make sure to look at each report carefully to

determine if you are looking at a cost center report or a revenue center

report.

The only difference with a

revenue center performance report is the determination of favorable or

unfavorable variances. Use the same methodology used in the cost center report.

Look to see if the actual amount is greater or less than the budgeted amount.

For the Standard Model, actual is more than budget. Here we are discussing

revenue. Is higher revenue good or bad? Higher revenue is good, so the $90,000

variance is favorable. The Deluxe Model has sales $20,000 lower than budgeted,

which is bad and therefore unfavorable.

A company should not just investigate

unfavorable variances. The Executive Model’s sales were 10% higher than

budgeted. The national sales director might want to know how the Midwest Region

was able to increase sales in order to help boost sales in other regions of the

country. Favorable variances are just as important as unfavorable variances.

Conclusion

Responsibility

accounting is a management control system based on the principles of delegating

and locating responsibility. The authority is delegated on responsibility

centre and the responsibility centre is accountable to achieve pre- defined

targets.

There

are various types of responsibility centres which are responsible for expense,

profit, revenue and investment etc. under this system the managers are

responsible for activities of segments. These segments can be departments,

branches or divisions, etc.

BIBLIOGRAPHY

Ø

Arora,

Manoj & Kumar, Vishal. ‘Business

Performance Measurement’. Kalyani Publishers.

Comments

Post a Comment